Every deadline season has the same rhythm: the obvious buyers shop, the obvious sellers shed, and then one team quietly starts acting like it doesn’t agree with the league’s assumptions. Sam Amick’s latest reporting has the Brooklyn Nets cast in that role; a “deep dark horse,” in his words, with one league source telling him Michael Porter Jr. is a “lock” to be moved by the deadline so Brooklyn can sell high on his career year.

If that’s even close to accurate, it reframes what Brooklyn is doing right now. This isn’t just about extracting value from a scorer having his best season. It’s about the Nets needing to decide who they want to be when the calendar flips to 2026–27, and why their situation makes “tanking” a lot less clean than it sounds.

The key detail Amick flags is the Nets’ looming 2027 first-round pick swap owed to Houston, a leftover from the James Harden trade tree that effectively means Brooklyn has less incentive to bottom out next season. When you don’t fully control your own downside, the typical rebuild script gets distorted. You still want draft equity, but you also need actual NBA players, because if you’re terrible in 2026–27, you’re potentially gifting the benefit to someone else.

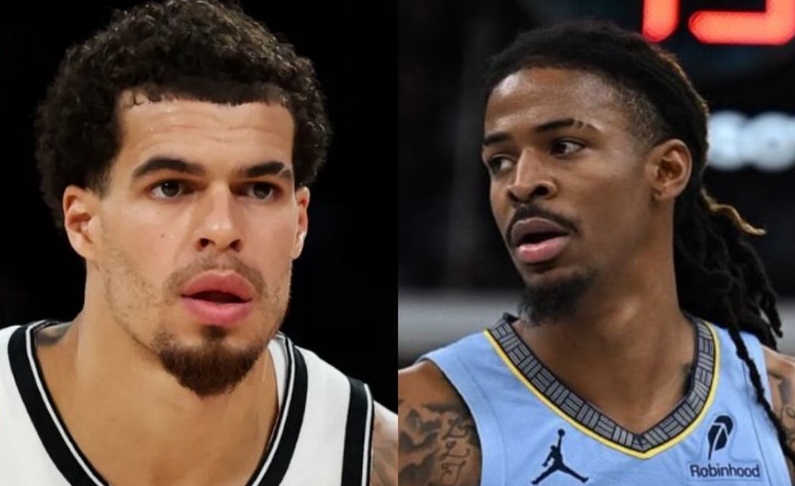

That reality is what makes the Porter/Morant thought experiment more than internet fan fiction.

Porter’s market case is straightforward. By the numbers, he’s playing at a level that changes how teams talk about him. Porter is at roughly 26 points per game this season with strong efficiency, the kind of production that immediately turns “nice scorer” into “offensive centerpiece.” And he’s not on a small contract that limits the return. Porter’s 2025–26 salary is $38,333,050, a figure large enough to be a true trade lever, and one that can help match money in star-level deals.

So if Brooklyn truly believes it can “sell high,” the question becomes: sell high for what?

Amick’s proposed answer is the biggest swing on the board: Ja Morant, plus additional assets. The timing is notable because the Morant market is suddenly real. Memphis is open to trading Morant, with multiple teams expressing interest and the Grizzlies prioritizing draft picks and young players in return. In other words, Memphis is inviting exactly the type of offer a Porter-centered structure could resemble: a premium player now, plus future value.

From Brooklyn’s perspective, it’s an elegant pitch: move Porter at peak value, “buy low” on Morant at a moment when injuries and volatility may have depressed the bidding, and solve a glaring roster problem, star guard creation, heading into 2026–27.

But it’s only elegant on paper because Morant is not a normal “buy low.” He’s a franchise-level talent with franchise-level risk. He’s under contract in the third season of a five-year, $197 million deal that runs through 2027–28, and he’ll be eligible for a three-year, $178 million extension this summer. Trading for him isn’t a one-year gamble; it’s a decision about identity, culture, and payroll for multiple seasons.

That’s why Amick’s framing has an edge to it. He sketches a scenario where Brooklyn gets Morant for the long term, but in the short term could let Morant’s calf issue linger deeper into the spring to improve lottery odds, the kind of wink-wink “strategic injury” insinuation that teams never admit to and leagues never like to hear out loud. The league and the players’ union have become increasingly sensitive to anything that smells like manipulation of competitive integrity, and medically, injuries are not props, particularly for a player whose career has already been shaped by missed time. Still, the fact that this idea is even being floated underscores what Brooklyn’s front office is wrestling with: how to thread the needle between asset collection and the practical need to be good sooner rather than later.

The basketball fit is the fun part, and also the complicated part. Porter gives you size shooting and scalable offense; he can be devastating next to a primary creator. Morant gives you the primary creator, the rim pressure that bends defenses, turns role players into finishers, and makes an average offense look inevitable. If you’re building a modern team, that type of guard is the hardest thing to find and the hardest thing to trade for.

But Morant also demands a level of organizational certainty. Your spacing must be real. Your defense must be sturdy enough to survive the nights when the offense is messy. Your accountability structure must be strong enough to absorb the spotlight he brings. Memphis deciding to listen on him is proof of how difficult it can be to manage all of that at once.

And that’s the tension humming under Amick’s “deep dark horse” line: Brooklyn is one of the few teams positioned to make a move that is simultaneously a rebuild tactic and a star play. They can chase draft capital while still plotting a near-term return to relevance, because the 2027 swap makes a prolonged bottom-out less appealing.

If Porter really is on the verge of being moved, the broader message is clear even before any Morant talks reach the goal line. Brooklyn is trying to align timelines. Porter’s “fantastic season,” as Amick put it, might be colliding with the organization’s bigger objective: determining who the Nets are going to be a year from now, when the league stops grading them on flexibility and starts grading them on results.